|

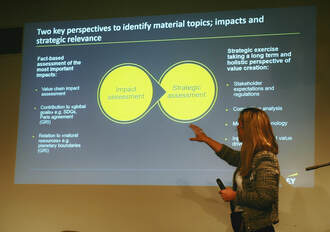

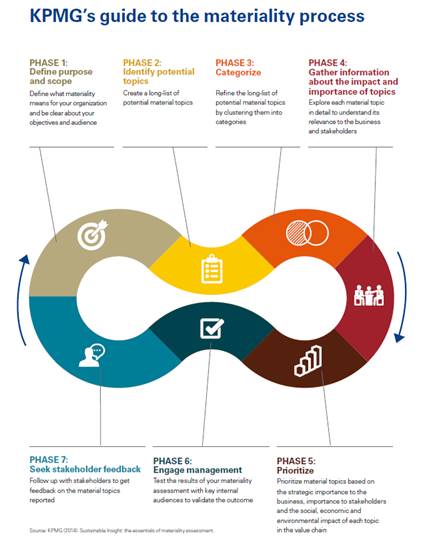

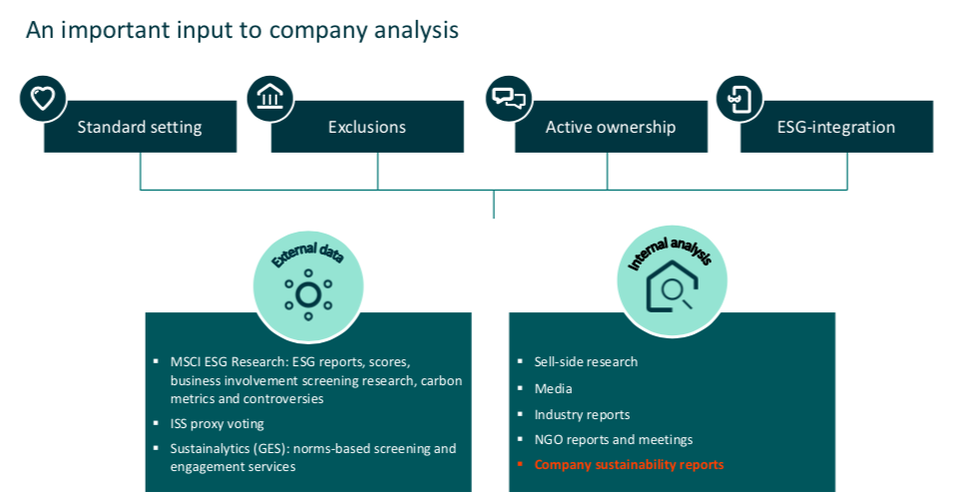

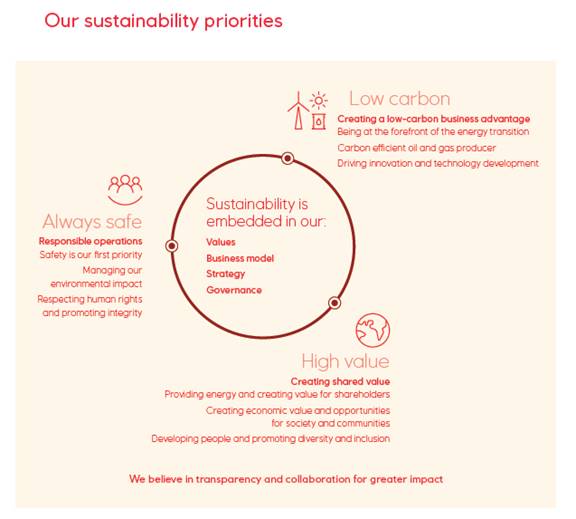

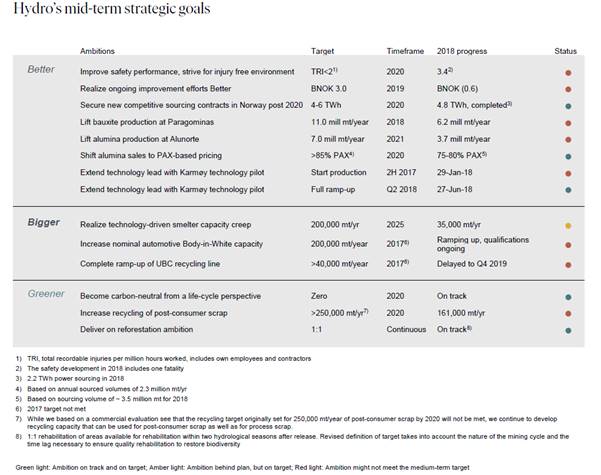

Access presentations and more photos from the Sustainability Reporting Seminar here. Sustainability reporting and ESG disclosures are evolving at an accelerating pace around the globe, and investors are increasingly using this information to inform their decisions. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations, the codification of the Sustainability Accounting Standards Board (SASB) Standards, and a new draft standard from the Global Reporting Initiative (GRI) on tax and payments to governments are increasing the reporting demands on companies. According to the Financial Times, there are at least 230 corporate sustainability standards initiatives across more than 80 sectors. Some believe this is way too many and that it’s leading to confusion for investors, stakeholders and companies alike. Hans Hoogervorst, Chair of the International Accounting Standards Board (IASB) cites the example of Tesla, which is ranked highest on the sustainability index of MSCI, while FTSE ranks it as the worst carmaker globally on ESG issues. Indeed, with growing evidence small and medium sized companies are struggling to understand and adopt sustainability reporting, Christine Lundberg Larsen, CEO of Regnskap Norge said, “We really need to develop the accounting standards on non-financial reporting so that it’s not just the bigger companies reporting, but everyone.” Calum Revfem, Executive Director of Proxima and New Zealand’s leading sustainability and integrated reporting specialist, gave reporting newcomers the advice, “If you’re new to sustainability reporting, don't try to reinvent the wheel – look to the leaders and model best practice. Then ask the fundamental question: why are we doing sustainability reporting? Hopefully it’s to be accountable and drive systemic change – if not, it's just another communications exercise.” Hanne Thornam, Head of Climate Change and Sustainability Services at EY Norway, told the gathering, “Sustainability reporting is evolving rapidly. During the last few years, we’ve seen an increasing focus on a company’s impact irrespective of its effect on the bottom line,” and advised the gathering to “Get a complete view of your impact and assess it in perspective of the SDGs and planetary boundaries, and then do the strategic assessment with this as the starting point.” You must materialize to sustainalize The opening session of Sustainability Hub's Sustainability Reporting 2019 explored materiality and stakeholder dialogue. Materiality assessment is the process of identifying, refining and assessing potential environmental, social and governance issues that could affect your business and/or stakeholders, and condensing them into a shortlist that informs company strategy, targets, and reporting. KPMG’s publication, The essentials of materiality assessment provides some valuable tips for conducting a materiality assessment and describes the seven key steps shown in the figure below. Anette Rønnov, Director Sustainability Services, explained how at KPMG Norway, “We believe that the companies which fully consider how sustainability topics interrelate with their business strategy, and develop sustainability materiality processes that link with the wider enterprise risk management process, will be in a better position to inform investors, regulators and other stakeholders on their environmental, social and governance impacts, risks and opportunities.” Energy giant Equinor is an example of this. Its Principal Sustainability Analyst, Øystein Kolstad, explained how “Equinor has sustainability embedded in our values, business model, strategy and governance,” and also revealed how, “According to CDP (formerly known as the Carbon Disclosure Project), we are the oil & gas company best prepared for a low carbon future.” Broadening the conversation, Anette Rønnov said, "Materiality assessment should be used as a strategic business tool, with implications beyond corporate responsibility (CR) or sustainability reporting. Organizations can get most benefit from their materiality process by using it as an opportunity to apply a sustainability lens to business risk, opportunity, trend-spotting and enterprise risk management processes.” Similarly, Hanne Thornam, explained that “Materiality assessment needs to be a strategic exercise too, and you can’t just use GRI to find strategic risks and opportunities. Assess what stakeholders will care about in the future, which regulations can affect your business model, how technology and markets will change, and how you can be part of a low-carbon future.” Hydro and Equinor are among the sustainability reporting leaders in corporate Norway. Kirsten M Hovi, Vice President and Head of Extra-Financial Reporting at Hydro, underlined how “A sound materiality analysis reveals what is most relevant to report and as such is fundamental to any financial and extra-financial reporting.” Øystein Kolstad described how “Thorough materiality analyses involving all our stakeholders concluded that safety and climate change are the two most material sustainability aspects for Equinor. In addition, human rights became an increasingly important issue in our 2018 sustainability report.” Purpose and people With discussions flowing into the subjects of purpose and stakeholder engagement, Astrid Thommessen Sæbø, Chief Financial Officer at SAP Norway, presented how SAP works with sustainability and integrated reporting based on SDGs and the GRI G4 financial reporting guidelines. SAP conducts semi-structured interviews with multiple stakeholders to determine which efforts to prioritize to increase employee engagement and customer loyalty. Thommessen Sæbø said “To assess and monetize the interdependency between non-financial factors including sustainability, business health and employee retention, SAP constantly refines its approach to materiality.” Suggesting that “The new materiality revolves around how to build customer loyalty and employee engagement,” she mentioned how “Our research indicates that particularly for the younger generations in the workforce, purpose is key for their willingness to engage in a business relationship with SAP.” Having measured that a 1% increase in its employee engagement will mean a EUR 50-60 million increase in operating profit, SAP has quarterly sustainability targets for all employees and makes local impacts visible to them, stimulating engagement and providing insights they can act upon. Tech, tools and thresholds The following session looked at fundamental changes in reporting technologies and frameworks. Alexandra Pittman, Founder and CEO of the B Corp ImpactMapper, described how this online tool helps donors, nonprofits and impact companies to track and visualize their social impact. “To move the world towards achieving the SDGs, and assess our progress along the way, we need a crystal clear impact framework and metrics. The same can be said for sound strategic decision-making and reporting,” she suggested. Pittman said "Corporates and impact investors are showing increasing interest in intelligence from sources other than KPIs, quantitative and financial data,” going on to explain how, “Insights from philanthropic enterprises and impact conversations can inform corporate business and catalyze vital conversations around sustainability.” Astrid Fellingham, Development Manager at the Future-Fit Foundation, suggested “To be a truly sustainable company, you must understand the social and environmental thresholds you need to reach and have a reporting and management framework to track progress towards them.”… Future-Fit Foundation is best known for its Future-Fit Business Benchmark, a free tool to help companies and investors transform how they create long-term value, for themselves and society. Fellingham described how the benchmark can “enable companies to talk about both positive and negative impacts in a credible, concise, holistic and comparable way which reveals the whole picture.” Reading between the lines The final panel discussion, moderated by Anette Rønnov, introduced perspectives from readers of sustainability reports. Those of us who have ploughed through reports to drill down into materiality and performance would agree with a participant who urged companies to “Focus on what is material! Otherwise it is easy for the reader to not see the forest for the trees.” Kjell Kristian Dørum, Senior Advisor at the Norwegian Pension Fund Global’s Ethics Council, said “From our perspective, the most important issue for corporate reporting is being open about sustainability-associated risks and challenges and being concrete and transparent about how they are handled.” Analyst Laura Natumi McTavish explained how DNB Asset Management assesses a business for positive impact using four pillars: standard setting, exclusions, active ownership and ESG integration. Anette Rønnov described how, “Rather than creating a separate, isolated process, leading companies embed sustainability within existing core processes,” and suggested Equinor and Hydro as examples of companies that have sustainability cemented in their corporate strategy, something which is reflected in both their annual reports and their reporting on strategic goals — as the illustrations below show. Kirsten M Hovi, Vice President and Head of Extra-Financial Reporting at Hydro, said "The correct reporting tools are essential. Hydro uses the GRI Standards, and through the GRI Index we show how our performance is linked to the Sustainable Development Goals, the UN Guiding Principles on Business and Human Rights (UNGPs) and various industry initiatives, etc.” Despite Hydro’s lengthy experience -- sustainability reporting since 1989; first materiality analysis in 2004; used GRI guidelines (now GRI Standards) since 2003 – they are still learning. “We are a signatory of the Task Force on Climate-related Financial Disclosures (TCFD) and have been reporting using their guidelines since 2017. An important step forward for us now is to develop relevant scenario analyses,” Hovi explained. If TCFD scenario analysis is a stretch goal for Hydro, a general development point for Norwegian business was suggested by Dan Jakob Wangen, Senior Consultant Climate Change and Sustainability Services at EY Norway: “In Norway, first time reporters are generally good on doing thorough materiality assessments. The development point is making reporting an iterative process, revisiting it yearly as factors change: materiality is not fixed but evolves as you change focus or strategy.” 2019: a good year Reflecting upon Sustainability Hub's second Sustainability Reporting Seminar, its Executive Director, Andreas Friis, concluded, “The discussion was much more advanced than 2018, suggesting that the experienced players are maturing fast, but there is still room for improvements. We are particularly pleased to see that sustainability has become more important for CFOs and C-level executives and to see more integrated reporting that goes beyond focusing on a few specific indicators.” Calum Revfem, Executive Director, Proxima, who was also impressed by the knowledge of the Norwegian gathering, rounded off with, “Many companies approach sustainability reporting and strategy as modular, singular tasks, but this doesn't address the interconnectivity of the core challenges. You need an overarching model of sustainability to go beyond piecemeal, do-less-harm actions to a vision of ‘how can we create abundance and value?’” Overview of reporting in New Zealand here

1 Comment

17/12/2021 09:24:38

Their team hit all deadlines and provided useful suggestions during the development process.

Reply

Leave a Reply. |

WANT TO PUBLISH AN ARTICLE HERE?

Have a read at our Publishing Guidelines: NEWSLETTER

Subscribe to our newsletter to get the sustainability articles sent to you every month. EDITOR

Lauren Guido |

|

Follow Us

Contact Us

|

Want to learn more? |